An insurance premium can go a long way in helping matters comfortable and motivating you to drive safely. As a sign of assurance, getting an insurance premium is quite essential, and every single dealer recommends the same. But for this purpose, you also need to think about the type of insurance and look into ways that can help you save money. Without these methods, you will be spending a lot on insurance premiums, and there is nothing you can do about the same. Hence, to help you out, here are some tips.

Look Around Before Finalising

The first step along the process would be to look at all sources that can grant you with an insurance premium. By doing so, you are making a move to understand their policy and see to it that options that make you feel comfortable are part of the list. You also need to begin the process of comparison since that will help you choose the best one that is also cost-effective. These steps are ideal and will open the door for a long list of benefits. Hence, let the game of checking and comparing begin.

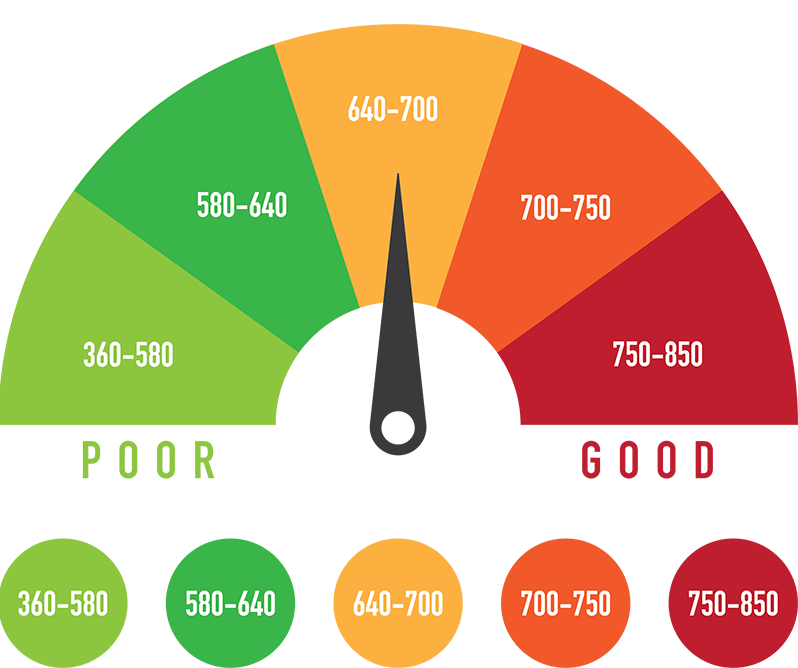

Credit Score

When it comes to insurance premiums, a good credit score needs to be maintained, and that goes without saying. All your previous loans need to be paid on time, and that also includes interest. When such things get aligned, you will be looking at a good credit score, and that is a point of trust for a lot of insurance companies. By all means, you also need to look into your habit of spending and form a limit. Once all that is in place, you can cut down on ways that force you to seek credit.

Mileage Discounts

If there’s one aspect that people have no clue about, then it is discounts related to mileage. Yes, that’s right. Companies tend to apply this rule and offer discounts to people who travel less than the average mile and maintain good mileage. This rule might also be applicable to people who carpool. Availing this discount will reduce expenses to a large extent, and you need to understand the same.

Other Discounts

The world of discounts does not end with mileage, and there are numerous options that fall into insurance. There are specific discounts that are offered to policyholders, and there are also discounts provided to individuals who have met with accidents. Your brief research about the company should help you bring out such aspects, as they help you cut down on costs in a drastic manner. Hence, remember these points and make sure you get the insurance that keeps you happy.